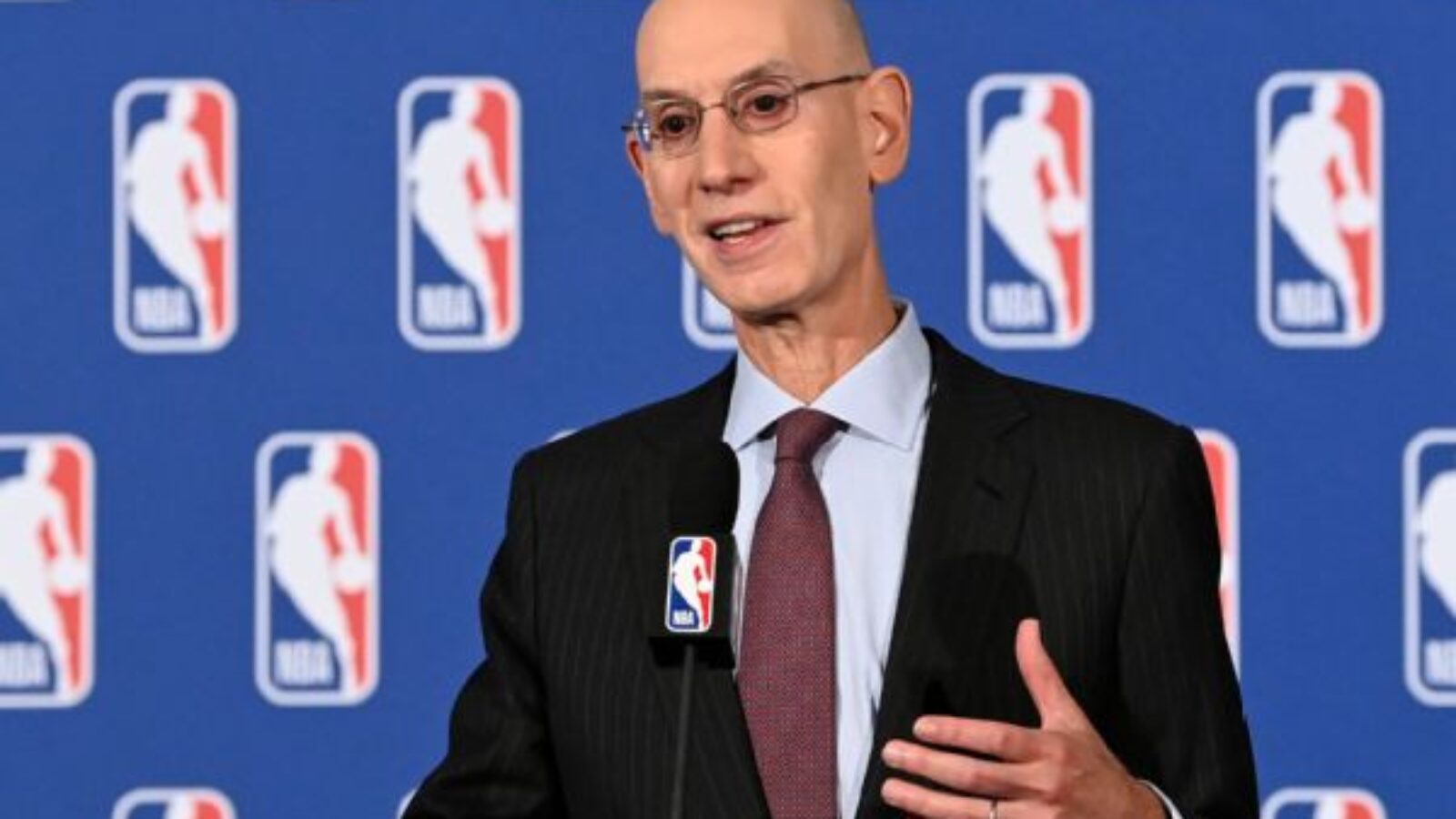

“I don’t want to say what could ever happen, but there’s no contemplation right now,” Silver said during a question and answer session at the Associated Press Sports Editors convention. “I mean, it’s very important to us, putting aside sovereign wealth funds that individuals are in a position to control our teams, be responsible to the fans, be responsible to their partners and to the players.

“It’s very important to us that there be a person [in charge], and this is independent of sovereign wealth funds. I think that in terms of the connection with the community, the connection with the players and their other partners in the league.”

Under the NBA’s current investment rules, the controlling owner of an NBA team has to own at least 15% of the franchise, and any sovereign wealth fund can only have a passive investment in a team of no greater than 5%.

Last month, Qatar’s sovereign wealth fund purchased a 5% stake in Monumental Sports & Entertainment, giving it stakes in the NBA’s Washington Wizards, the WNBA’s Washington Mystics and the NHL’s Washington Capitals. And one of the biggest stories in North American sports over the first half of 2023 has been the potential merger of LIV Golf, which is funded by Saudi Arabia’s Public Investment Fund, and the PGA Tour.

In recent months, both the Milwaukee Bucks and Phoenix Suns exceeded the previous records for franchise valuations in their recent sales, with Marc Lasry’s stake in the Bucks going for $3.5 billion in March and Mat Ishbia purchasing the Suns from Robert Sarver for $4 billion in February.

Those valuations skyrocketing in recent years played a part in the NBA opening up the ability for private equity firms and sovereign wealth funds to purchase stakes in teams. According to Silver, there are fewer and fewer individuals capable of writing those checks. But he also argued that those valuations are not part of a bubble, saying that the underlying economics of the sport and the value of live sports, in general, validate them.

“I think a bubble would be indicative of sort of irrational valuations,” Silver said. “I think if you look at the revenues, at least in the case of the NBA being generated by the league, the opportunity for growth, the global market that we’re addressing here, and maybe there’s certain unique aspects to the NBA because of how global our league is.

“I don’t think there’s anything irrational at all. In part, the reason why we’ve opened up investment opportunities to private equity firms, sovereign wealth funds, is because we’re running out of individuals, frankly, who are in a position to write those kinds of checks, and especially when you’re not going to be the control owner of the team.”

Silver added he believes those entities see the value in buying into the NBA — and buying into the value of live sports — to back up his argument.

“Interestingly enough, those funds are making financial investments in these teams,” he said. “To me, I think the investment community is just following that trend and saying this is a true growth opportunity.